What We Do

Tideline is a specialist consultant charting a course with expert advice and actionable tools for clients implementing impact investment solutions.

Tideline’s mission is to enable leading investors to integrate and deliver impact with confidence.

Overview

Tideline was founded in 2014 as a Certified Women Owned Business by Christina Leijonhufvud, Ben Thornley, and Kim Wright-Violich, who together brought over three decades of impact investing experience to the firm and a vision to build a specialized consultant for the impact investing market. True to this vision, Tideline has played an important role in the growth and maturation of the impact investing industry with a long history of pioneering many of the concepts and practices that have evolved into today’s industry standards. From the introduction of “impact classes” to the development of a methodology for “impact verification,” Tideline has continuously helped raise the bar for impact investing with 145 projects completed to date and influencing clients which advise and manage $13.5 trillion.

Tideline is a certified Women’s Owned Business, a member of the Global Impact Investing Network, and an Affiliate Member of Mission Investors Exchange.

Consistent with Tideline’s mission of “enabling investors to integrate and deliver impact with confidence,” our approach to impact investing consulting has always emphasized excellence, commitment, and openness. These values guide not only every client interaction and assignment, but also how we grow the firm and empower our team. This ensures that our work is genuine and contributes to scaling the impact investing industry with integrity.

“

AEO has been working in the microbusiness and microfinance industry since 1991. We have had previous strategic mapping initiatives, but none as effective or utilized as consistently as the growth plan Tideline helped us devise. It has been such a powerful guide to our work, and now with eighteen months into our implementation, we are well on the way to reach our longer-term aspirations. Our Growth Map has resulted in a growing number of new private-sector partnerships. All of this comes at a time when services like AEO’s are critical for underserved entrepreneurs, particularly Black-owned businesses.

Connie Evans

President and CEO

Association for Enterprise Opportunity (AEO)

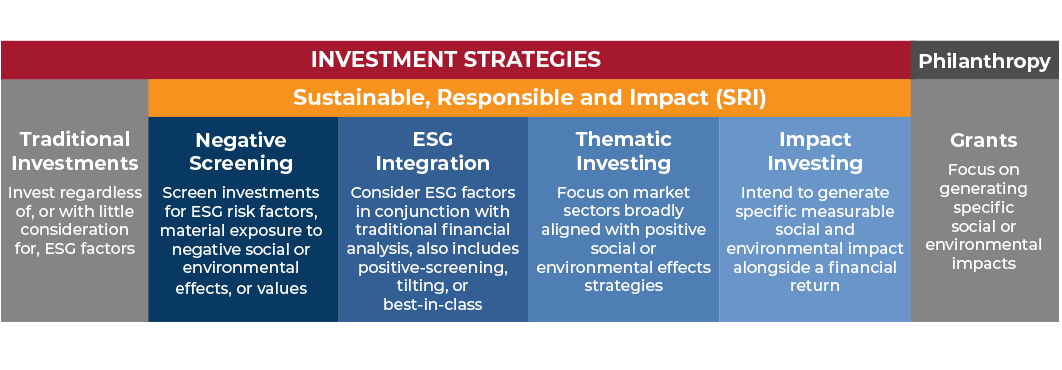

What is impact investing?

The Global Impact Investing Network (GIIN) provides the following definition:

“Impact investments are investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return. Impact investments can be made in both emerging and developed markets, and target a range of returns from below market to market rate, depending on investors’ strategic goals.”

Diversity, Equity & Inclusion

At Tideline, our commitment to diversity, equity and inclusion manifests in three key ways:

The mission and vision of Tideline

Our firm’s vision of shared, sustainable prosperity is inseparably rooted in the credo of a diverse, equitable, and inclusive world.

How we conduct ourselves as an employer

Tideline is an equal opportunity employer, and we value the unique contributions of each of our team members. Through our hiring, mentoring, and managing, we encourage our team to bring their full selves and individuality to Tideline’s work.

How we use our influence

In our work with clients, we strive to be an enabling force in the equitable distribution of wealth, opportunities, and privileges within our society.

“

Responding to the critical lending and wealth gaps faced by Black entrepreneurs and families, Tideline stepped in as an integral partner in development of the Black Vision Fund. By analyzing the specific financing needs of seven community development finance institutions (CDFIs), Tideline was able to help create a customized investment vehicle to channel capital to Black-owned small businesses and Black communities.

Mary Houghton

Planning Committee Chair

Expanding Black Business Credit