A video recording of Tideline’s Compass Series event on “Impact Investment at the Institutional Tipping Point” (WATCH)

In this Compass Series event, Tideline was joined by asset managers, allocators, and service providers to discuss the key developments in the impact investing industry that are laying the groundwork for full-scale institutional adoption. The conversation built...

Pensions & Investments – “How institutional is impact investing?” (by Jane Bieneman)

This piece was originally published in Pensions & Investments. The impact investing market is gaining steam, as evidenced by nearly daily announcements of new products and entrants, not least of which is Temasek’s $500 million investment in LeapFrog in March 2021....

Tideline advises J.P. Morgan Private Bank on design of firm’s Global Impact Fund

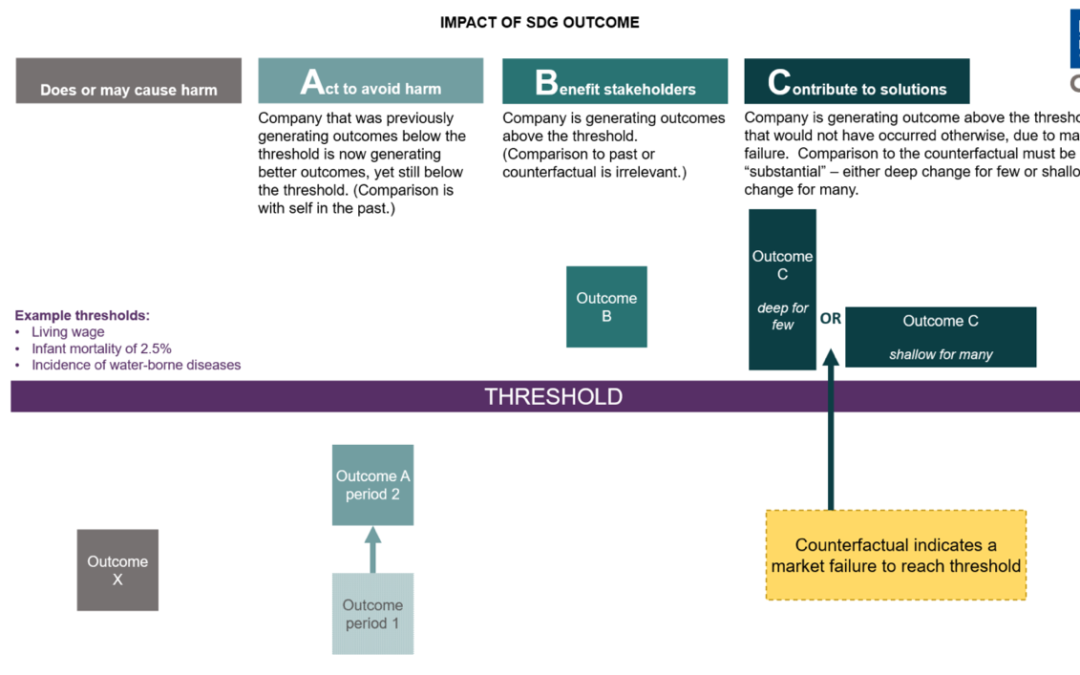

ImpactAlpha – “The ABCs (and SDGs) of classification for impact investing strategies”

December 15, 2020 | Originally posted on ImpactAlpha Five years ago, we co-led a research project exploring the value of classification in impact investing, with the goal of making it easier to invest for impact across a portfolio. At the time, the publicly traded and...