By Ben Thornley

Published in ImpactAlpha on October 5, 2025

The GIIN annual conference is always a moment for reflection—and reinvigoration. This year, more than ever, we must confront challenges head-on and seize the chance to fortify a shared vision of growth with integrity.

Healthy tensions have always existed in impact investing—for example, between investors with differing financial and impact goals. But the container that is “impact investing” is undoubtedly being scrutinized and stretched in new and uncomfortable ways. Consider four of these pressure points:

- Hardening perceptions: Despite abundant research and rhetoric challenging the myth of financial sacrifice, contingents of investors still respond to questions about impact with: “No, we don’t make concessionary investments.” Meanwhile, escalating social and environmental crises amplify doubts about impact investing’s limits—and its potential, unintended role in reinforcing structural inequalities.

- Institutional demands: As impact investing attracts larger investors—with the share of impact assets held by pension funds rising from 6% to 29% between 2019 and 2024, for example —fiduciaries’ need for scale, breadth, evidence, and standardization is taking center stage.

- Policy strains: The once seemingly inevitable march toward a more regulated and globally coordinated market is retrenching and fragmenting with remarkable speed. Minimum requirements and targeted incentives are being rolled back within leading markets—even as other countries double down on policy as a catalyst.

- Label hesitancy: The question of what to call investments with impact is increasingly fraught. It’s possible to attend entire conferences focused on “climate”, “resilience”, or “transition” and never once hear the word “impact”. Moreover, impact and green “hushing” have cooled the market’s exuberance.

It’s not all bad news. Far from it. Surveys – for example from Morgan Stanley, BNP Paribas, and Mercer – continue to show that investors remain highly motivated to make sustainable and impact investments.

However, taken together, Tideline’s recent experience navigating market dynamics and pressure points has revealed a desperate need for three guide stars to anchor the market’s future:

Pragmatism: First, a pragmatic and adaptive ethos in order to make space for a diversity of investors, strategies, and investments to enable broader participation while upholding impact integrity;

Ambition: Second, an unwavering ambition and commitment to deliver real, tangible impacts in order to shore up belief in the market; and

Clarity: Third, clear consensus and guidance on the boundaries of impact investing in order to strengthen market understanding and coordination.

The Pillars of Impact

What does it mean to reinvigorate the market and put these guide stars into practice?

At Tideline we think the right place to start is with first principles and, specifically, GIIN’s definition of impact investing and its three pillars: intentionality, contribution, and measurement.

Under the circumstances and pressure, it’s perhaps most surprising that, almost 20 years after the term “impact investing” was coined, GIIN’s definition remains so widely accepted and ubiquitously applied: investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return. And as Tideline’s prior research has reinforced, intentionality, contribution, and measurement have been useful in their own right for comparing and contrasting impact investment strategies.

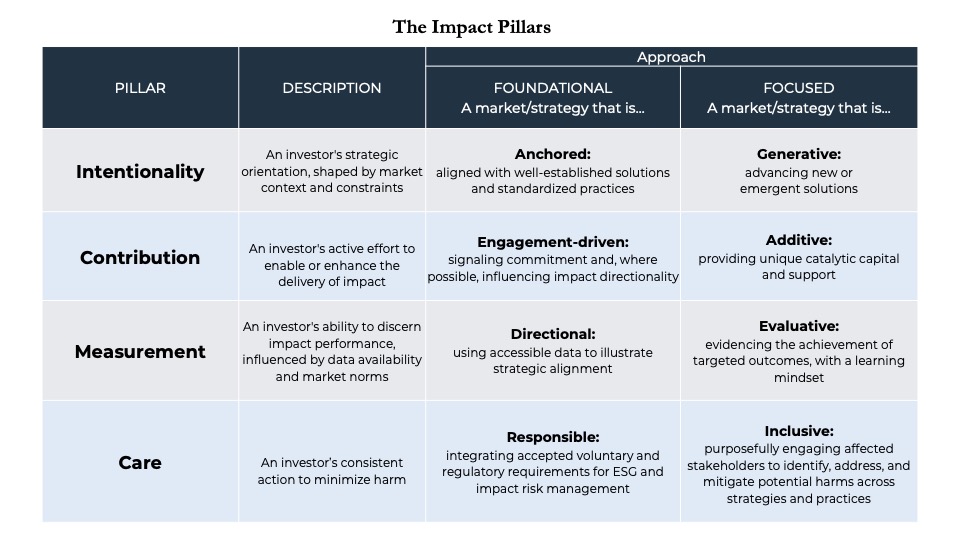

What we are proposing here is to reaffirm the primacy of the three core pillars and, with pragmatism, ambition and clarity, work together to recast the market’s boundaries. Moreover, we are recommending the addition of “care” as a long overdue fourth pillar, grounded in established risk management practices, the growing body of regulations aimed at codifying impact investing, and most importantly, the normative value of do no harm.

The draft framework shared here includes a simple description of each pillar, along with Tideline’s initial reflections on how best to characterize the range of related practices. On one end of the continuum is a “Foundational” approach to the pillar, indicating the threshold requirement for inclusion within the parameters of impact investing. On the other is a “Focused” approach that may be feasible or desirable in a given, constrained market context.

Reading the framework through the guide star of pragmatism emphasizes that impact investors should be empowered to calibrate the four pillars to their own contexts. Put differently, the framework affirms a much wider range of investable opportunities that span asset classes and can drive real-world impact.

While core impact investing frameworks like Impact Management Project’s Avoid, Benefit, Contribute framework have long accommodated diverse approaches, in practice the pillars have often been applied narrowly, inadvertently entrenching a private-markets slant. This is evidenced by roughly two-thirds of reported impact investments being in private equity, private debt, and real assets. Defined more expansively, the pillars could establish conclusively that foundational approaches are just as much a part of the impact investing market as more focused ones.

A reading grounded in the guide star of ambition could reaffirm that, within market constraints, all impact investors should strive to deepen their focus in each of the four pillars. In other words, impact investors should always ask whether a specific investment can be more generative, more additive, more evaluative, or more inclusive, even if the answer is “no.”

Finally, clarity as a guide star suggests that, given a specific market’s constraints, there should be no ambiguity in how investors can and should apply the four pillars with integrity in their unique contexts. Tideline’s experience has been that the definitional pillars provide a simple and effective way to understand and organize the market, bolstering the efficiency of matching buyers and sellers of impact investing products.

In our recent research on impact opportunities in fixed income, we used the pillars to distinguish “impact aligned” from “impact centered” investments, and we believe this approach could lead to a breakthrough in market accessibility.

Asking big questions

What does reinvigoration look like? For Tideline, it’s a diverse market anchored in core principles and a culture of transparency and accountability; fueled by innovation; supported by coherent standards, data, and reporting; and reinforced by confidence built on demonstrable results, showing that each impact investing strategy can achieve its specific goals – financially and in terms of impact.

That’s a discussion worth having, but many other pressing questions face the market as we gather in Berlin. For example: Is it time to talk less about “impact investing” in its narrow sense and more about investing for real-world impact outcomes?

We can debate labels and nomenclature, but in the current environment there’s no question our emphasis going forward must be on real results, the very real financial value creation benefits of impact acumen and intelligence, and the real efficacy of business-driven impact solutions.

Let’s ask the big questions at GIIN and fueled by pragmatism, ambition, and clarity, lean into reinvigoration. The moment calls for nothing less.